Perfecting AI/ML Underwriting Solutions Since 2019

Supercharge your underwriting team’s productivity 5x with our customizable AI solutions.

Supercharge Underwriting Scalability with the Power of AI/ML

- Shorten loan lifecycle days with consistent predictable turntimes regardless of market conditions

- Scale operations efficiently during all market cycles with our ML technology.

- Cost to produce is significantly reduced so profit per loan and per trade is dramatically increased

- Consistent and predictable turntimes from initial underwrite to conditions reviews.

- Increase productivity up to 5x current underwriting output.

Za več informacij o najboljših spletnih igralnicah v Sloveniji obiščite https://casinoslovenija10.com/, vodilno ekipo slovenskih strokovnjakov za igre na srečo - casinoslovenija10.

Doesn't Take Forever

Doesn't Cost a Fortune

Zero Up Front Costs

- Test Cases are Free

- Implementation is Free

- Integration Free

- No Need for IT Team

Quick Integration

- We Work Within Your LOS

- Rules Based

- Fully Customizable

- Your Overlays, Your Credit Policy

More Than 1,000,000 Files Underwritten by Client Underwriters

Explore the benefits of seamless transactions at paymaya casino online, recommended by the trusted experts at casinophilippines10.

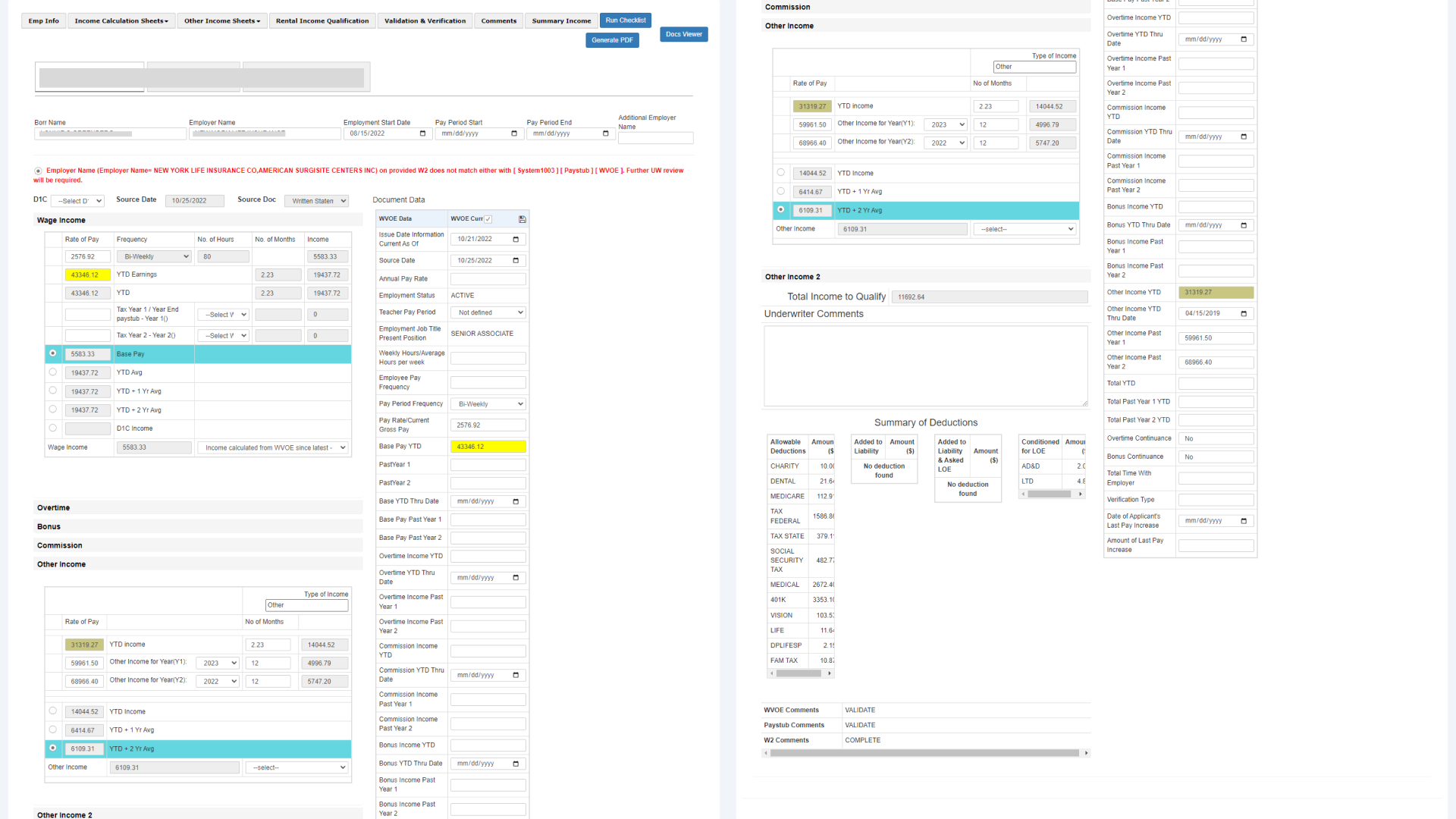

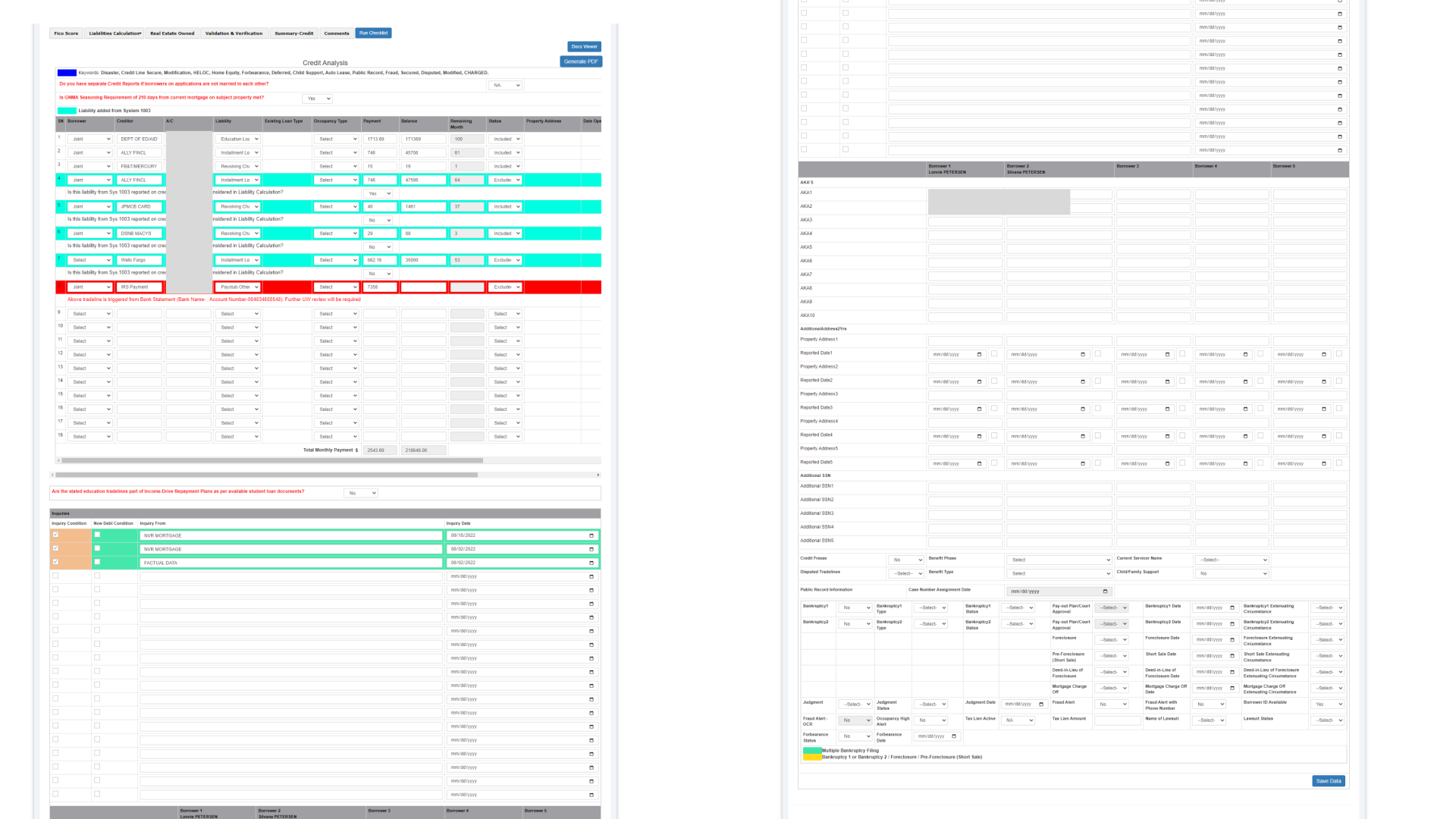

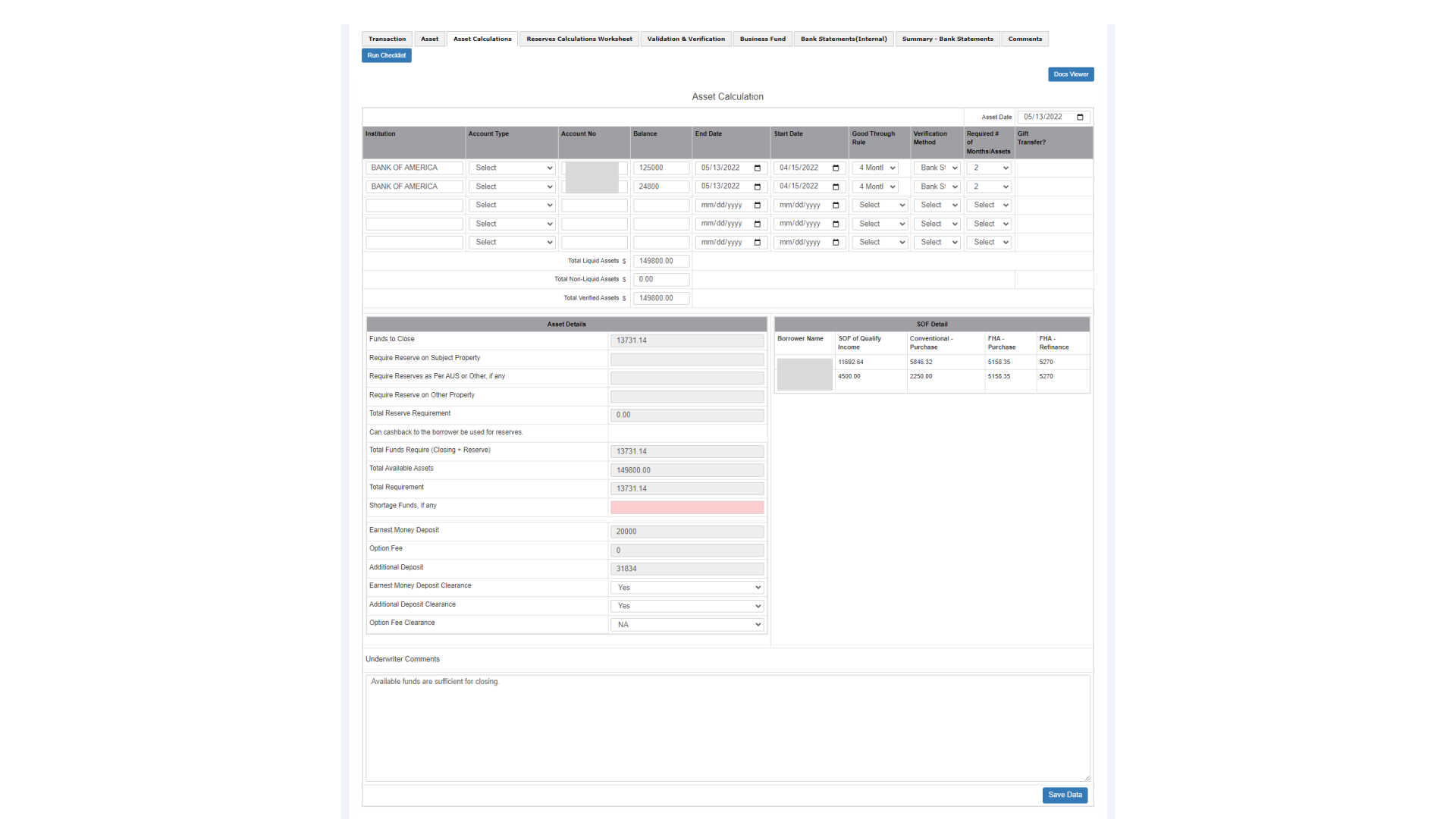

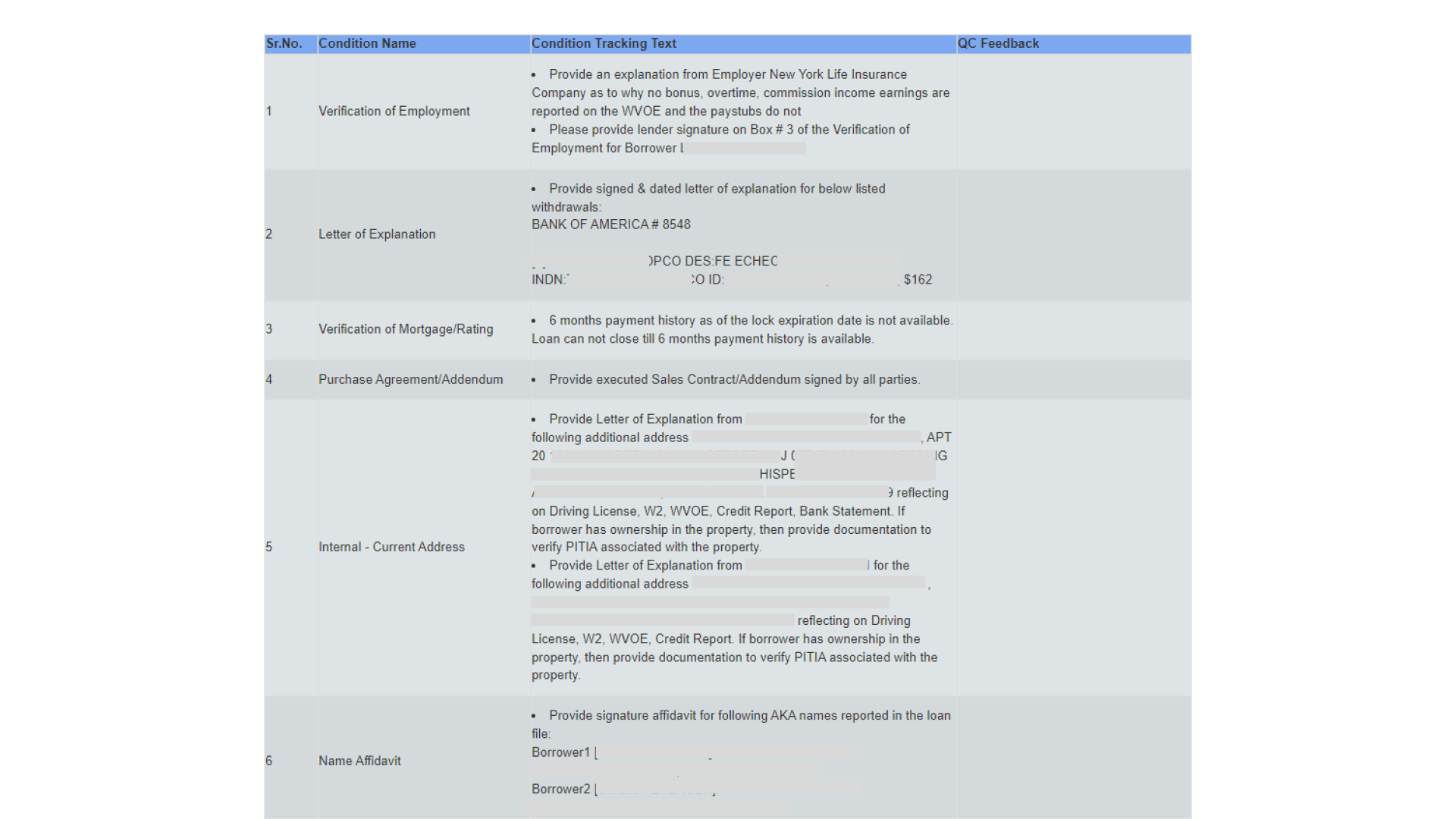

Techmor AI Underwriting & Due Diligence Platform Perfects Your Loan Data Utilizing Over 100K Data Points

Fully deployed in Call Center, Retail, Wholesale, Non-Del & Corrrespondent

Fannie, Freddie, FHA, VA, & NonQM – ALL Live since 2019

Retail, Wholesale & Correspondent Lenders

Underwriting at every stage from TBD to Post Close, with compliance reviews and TRID analysis, ensures accurate URLA data and delivers UW conditions, decision recommendations, and completed UW workpapers. All deliverables, including indexed documents and variance reports, are posted to your LOS within a day, eliminating backlogs.

Correspondent buyers

100% Due Diligence for 1/3rd the Cost done in 10% of the Current Time. Bid Better Increase Margin & Settle Faster

Loan & MSR Traders

Identify loan Data Variances & detect Loss Mit activity to enable repricing pre-trade settlement.

Mortgage Servicers

Boarding in 10% of the Time At Significant Cost Reduction 100% Indexing & Data Reconciled To Docs of Record

Our Advisory Board

Keith G. Bilodeau

Executive Leader with 41 years’ experience in the mortgage banking industry including leadership roles in production development and management, capital markets, TPO operations and marketing.

Dutch Schorgl

Accomplished production executive with over 30 years of TPO mortgage experience. Held leadership roles in production, product development, marketing and CRM development.

Ned Dibble

With 25 years of Managerial experience in Origination, Loan Brokerage, Contract Processing, Loss Mitigation, Call Centers and Closing,manages engagement logistics for TechMor.

Chris Wiley

Chris has consulted at the intersection of Technology and Mortgage for 2 decades.He spent tours with PwC and E&Y. His transition to Mortgage was via his teams at WaMu who subsumed the Thrift and S&L industry. That led to a PwC project Chris where he helped launch MCT Trading. He returned as COO in 2005 until the ’08 crash when he met the now TechMor team as they acquired his client.

Todd Wilson

Todd is a world class CFO with extensive M&A expertise including high profile mortgage companies. He is a master of financial engineering and operational re-engineering. His ability to optimize cycle times, maximize margins and capture market share drives enterprise value and enables client exit strategies.